Market Minute: S&P Futures Plunge -3% After Fed Hints At Slower Future Rate Cuts

Yesterday’s Federal Reserve policy meeting dumped a bucket of ice water on what had been a red-hot equity market, as traders digested the widely anticipated -0.25% interest rate reduction but also assessed the potential of slower-than-expected rate cuts next year. S&P 500 futures (/ES) plunged -3% by the day’s end on heavy volume and bottomed out at 5,906.50, while the VIX closed at 27.62 marking the highest levels seen since early August.

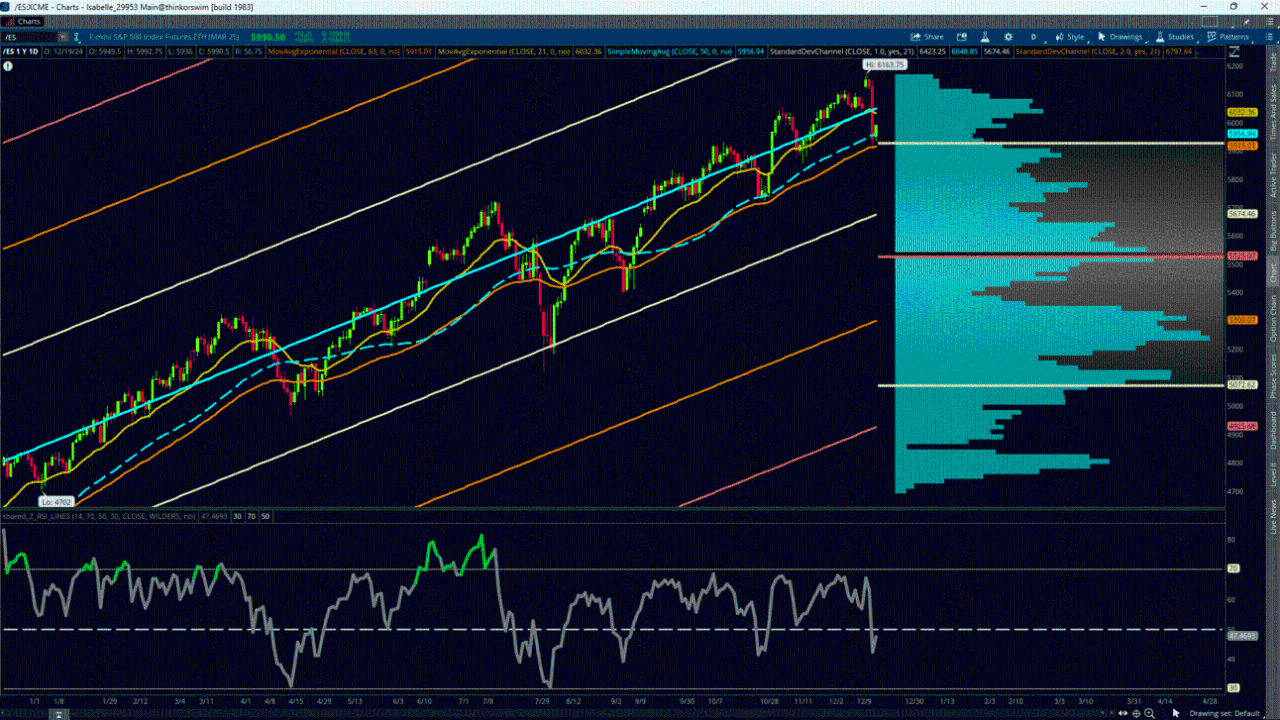

The /ES obviously took a hit as relentless selling persisted through the session. Price closed below popular short-term moving averages like the 9-day Exponential Moving Average and the 21-day EMA, but most notably sank below the 50-day Simple Moving Average (currently near 5,957) after testing and holding around the 63-EMA (currently near 5,915). The /ES is seeing a bit of a bounce in early trading and has recovered above the 50-SMA, but these could still be important areas to watch for short-term traders.

Momentum also took a significant dip, as shown by the Relative Strength Index closing below its midpoint of 50. This crossover suggests a shift from bullish to bearish momentum, so look for the indicator to either make a significant new low along with price, or to cross back above the 50 midline once again for further directional clues. But the cracks were perhaps beginning to show already on Monday. The RSI showed bearish divergence, in that it made a lower high even as price made a higher closing high – something typically viewed as potentially problematic for the health of an uptrend. Technically minded traders also may have noticed that the Moving Average Convergence Divergence indicator (MACD) made a bearish crossover back on Dec. 10, so momentum was already struggling when viewed through this different lens.

The question for today is whether the rally will hold and price will resume its grind to the upside, or if this is the start of a more bearish situation for equities. To the upside, the yearly Linear Regression Line (line of best fit based on closing prices) is typically viewed as an idea of fair value and comes in near 6,049, so this could be an upside area to watch. Just below that, there also is the 21-day EMA near 6,032 and both areas are encompassed within a notable volume node center around about 6,050. To the downside, the 63-day EMA sticks out as a potential line in the sand, and beware of a move beyond the next set of lows from mid-November around 5,855 or so.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.