Market Minute: Tesla – Driving to the Downside.

Tesla (TSLA) stock continued its slide on Monday with shares of the electric vehicle maker plunging over 15%, their worst day on the market since September 2020. The stock is on a seven-week losing streak and settled yesterday at 54% below its all-time high from December. The losing streak comes after CEO Elon Musk took his position in the White House to lead the Department of Government Efficiency. The losses have added up to over $800 Billion dollars of market cap lost and Tesla has now forfeited more than all of its post-election gains, with this decline another piece of the persistent unwind of the "Trump trade" that has defined market action in recent weeks.

While the diversion of Musk’s position along political lines has pressured sales, the economic background of weakening consumer sentiment has also hit the stock. His political rhetoric has eroded the outlook for sales in the near-term and data on sales from overseas have been plunging. During an interview on Fox Business after hours on Monday, Musk was asked how he manages to run his businesses while fulfilling his role in the Trump White House. He said he’s doing so “with great difficulty.” Musk also said during the interview that he expected to remain in the Trump administration for another year. After the broadcast, he posted on X that “It will be fine long-term,” referencing Tesla’s steep stock price decline.

The stock is now oversold on a technical basis with the Relative Strength Index (RSI) settling at the 20 level yesterday. Anything below a 30 on RSI is considered oversold on a technical basis. Implied Volatility is at over 3-year highs in Tesla stock on the sell-off. Tesla’s biggest bulls on the analyst side have been outspoken over the past few sessions. Last Thursday, Wedbush analyst Dan Ives doubled down on his pro-Tesla views, calling the current slump a "gut check moment for the Tesla bulls (including ourselves)." Ives added Tesla to the firm's "Best Ideas List" and reiterated his Outperform rating and $550 price target. And yesterday, Morgan Stanley kept an Overweight rating and $430 price target on Tesla. The firm stated the stock is down 50% from December 17th highs on poor sales data, negative brand sentiment, and market de-grossing, but this pullback is a buying opportunity for this "embodied AI compounder".

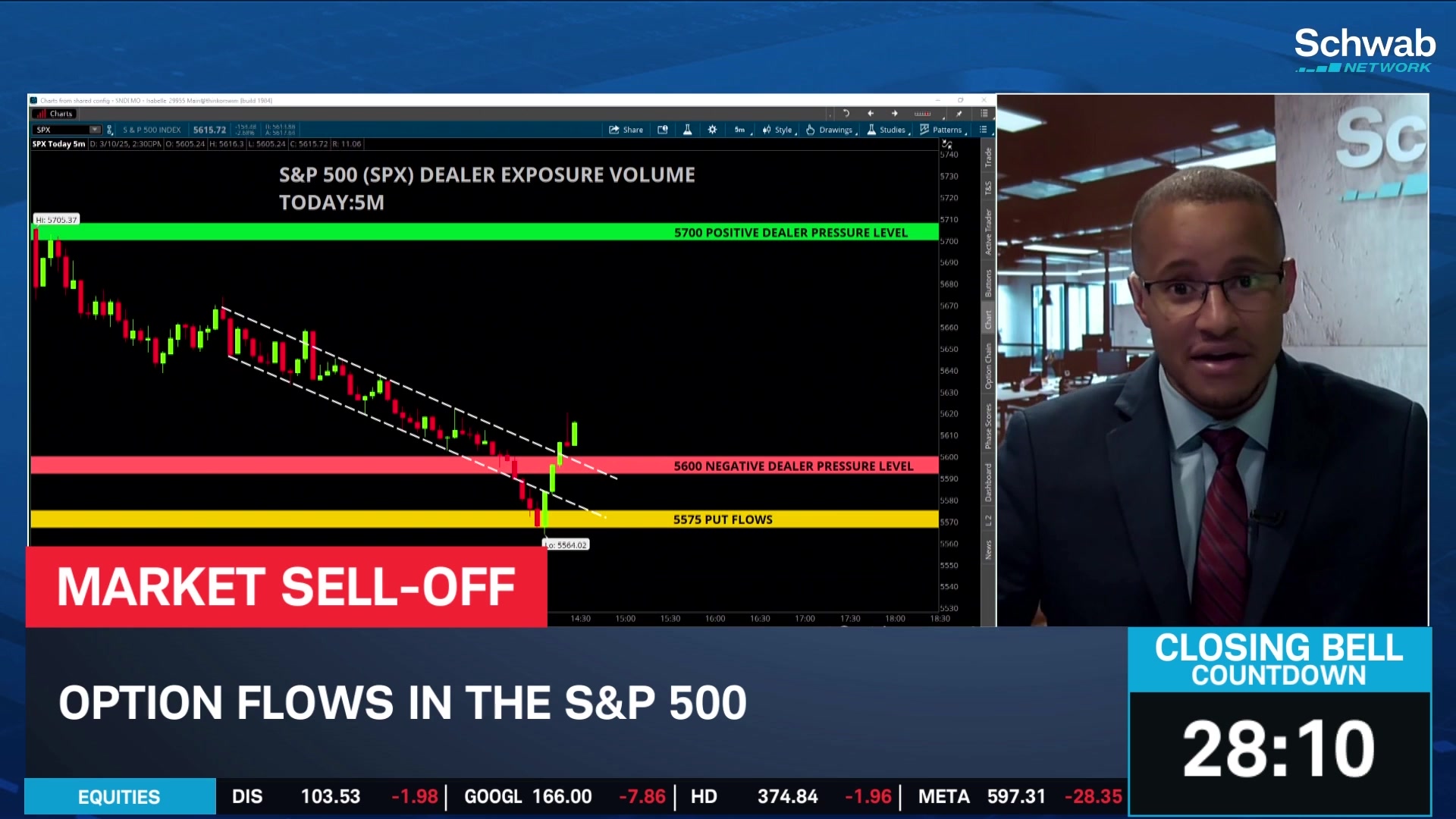

Expect more volatility in the stock over the near-term as the sell-off in the overall equity market is also pressuring the shares.

Featured clips

Mag 7's Fall, AAPL v. TSLA Valuation & Return to 'More Normal' Market

Morning Trade Live

► Play video

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.