Market Minute: Weekend Spotlight on Xometry (XMTR) Building New Ways of Manufacturing

Xometry’s CEO & co-founder, Randy Altschuler, explained that “digitizing manufacturing” is the next evolution for the sector, bringing it from pen & paper, back-of-the-napkin work to easy 3D design.

Founded in 2013, Xometry is an on-demand industrial parts maker. They offer a broad range of ways to create custom parts, including laser cutting, injection molding, urethane casting, and more, as well as a choice of over 70 materials. “We’re your partner from prototyping to production and beyond,” their website announces.

Altschuler says they serve businesses across the size spectrum, from tiny operations to the biggest companies in the world, such as Dell and GE. He adds that, “Our enterprise customers are embracing us more,” and using the full range of their offerings.

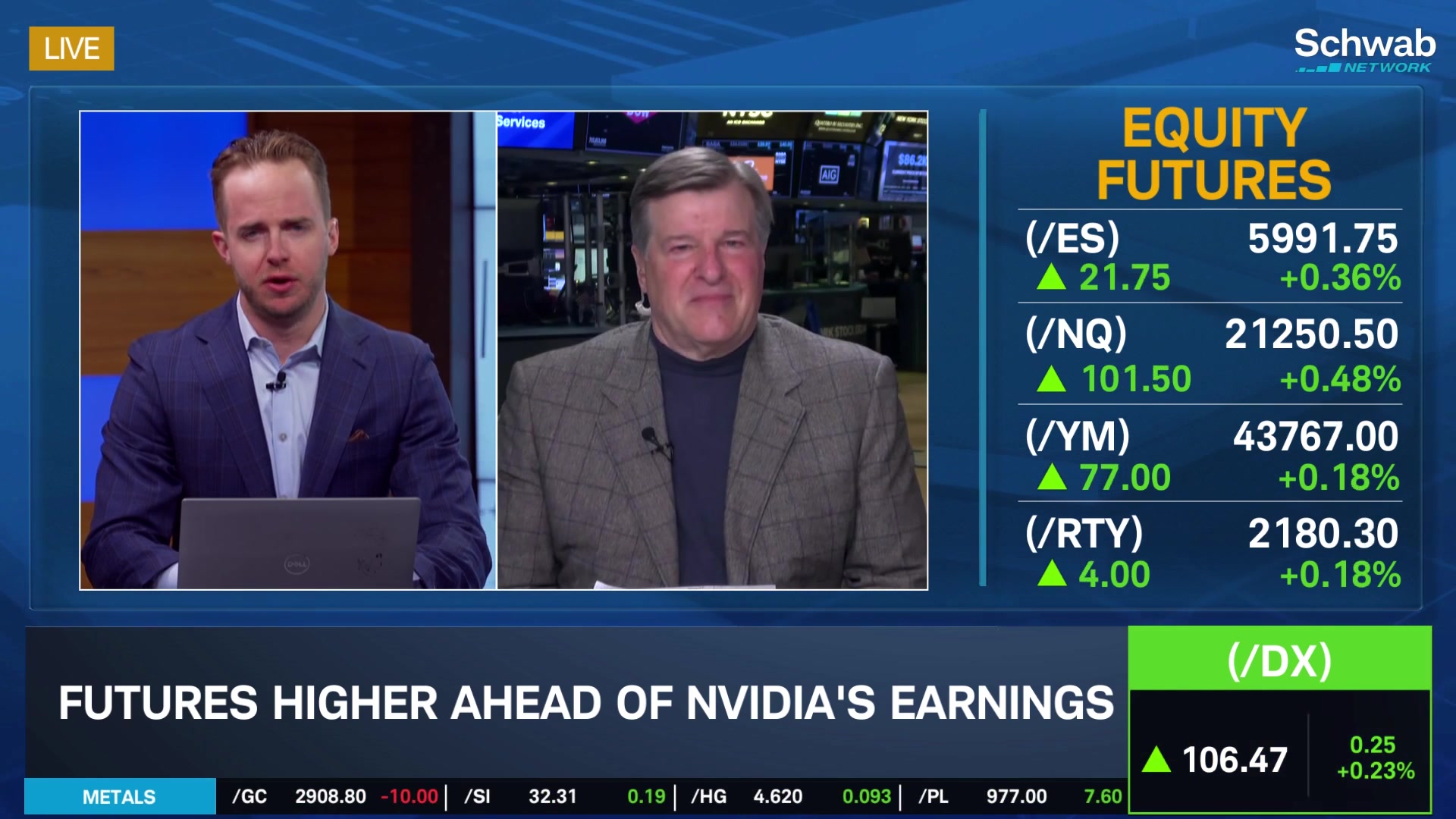

The stock plunged after its recent earnings and is down 11% over the past year, and over 35% year-to-date. Its 4Q adjusted EPS of $0.06 and revenue of $148.5 million beat Street estimates, but its revenue forecast for 1Q disappointed. Altschuler rebuts the market reaction, arguing that they guided to “accelerated revenue growth” in 2025 and that Xometry is “feeling very good” about its outlook.

On the earnings call, Altschuler said that its A.I.-powered marketplace “delivered record revenue, record gross profit, and record marketplace gross margin.” Active buyers reached over 68K at the end of the year, while Active Suppliers crossed the 4K mark. They are expanding in Europe and reached a run rate of $100 million internationally. Altschuler points to brand awareness and client growth as their big hurdle.

As a broker, there are really two segments to Xometry’s business: building a network of “trusted” manufacturers and building a client base looking for parts. Let’s start with the manufacturing side.

They’ve created a network of thousands of manufacturers, and Xometry claims it can “create, kit, and provide turnkey products to your specifications.” Manufacturers benefit by Xometry removing the bidding process, saving them time and resources. Xometry also offers “jobs from across the country,” broadening utilization and demand access, and brokers deals on supplies.

This network, in turn, makes Xometry agile and flexible with what they can create and the capacity they can offer. Their A.I.-powered platform offers pricing, lead times, and other feedback – a boon to all sides by generating estimates quickly, mocking up products, and checking ‘design for manufacturability’, or DFM, in a self-guided creation process. Xometry boasts that the A.I. can highlights areas of concern in a client design – another potential time and money saver.

A testimonial from NASA says, “Parts are so fast and cheap that we can change the way we work and design. Xometry’s CNC machining service saved the day.”

With worldwide growth, huge customers, and A.I. integration, Xometry seems well-positioned, especially with tariffs threats and inflation, because of its ability to do small-batch, custom work across geographies. Investors must weigh whether its recent fall is a case of inflated expectations by the Street, or a sign of underlying difficulties.

Featured clips

DeepSeek ‘Shot a Hole in the Heart of U.S. Exceptionalism’; Exodus to International Equities

Morning Trade Live

► Play videoCharles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.