Market Minute: Will Amazon & Apple Earnings Be Tricks or Treats?

Two of the Magnificent Seven stocks, Apple (AAPL) and Amazon (AMZN) will report their quarterly earnings in today’s Halloween postmarket, so traders have a potentially scary situation to weigh – the idea that both corporate giants, on which so much of the market’s gains have rested, could post weaker earnings and send stocks tumbling. Alternately, what if strong earnings from these major companies propel the indices into fresh all-time highs, once again burning bears?

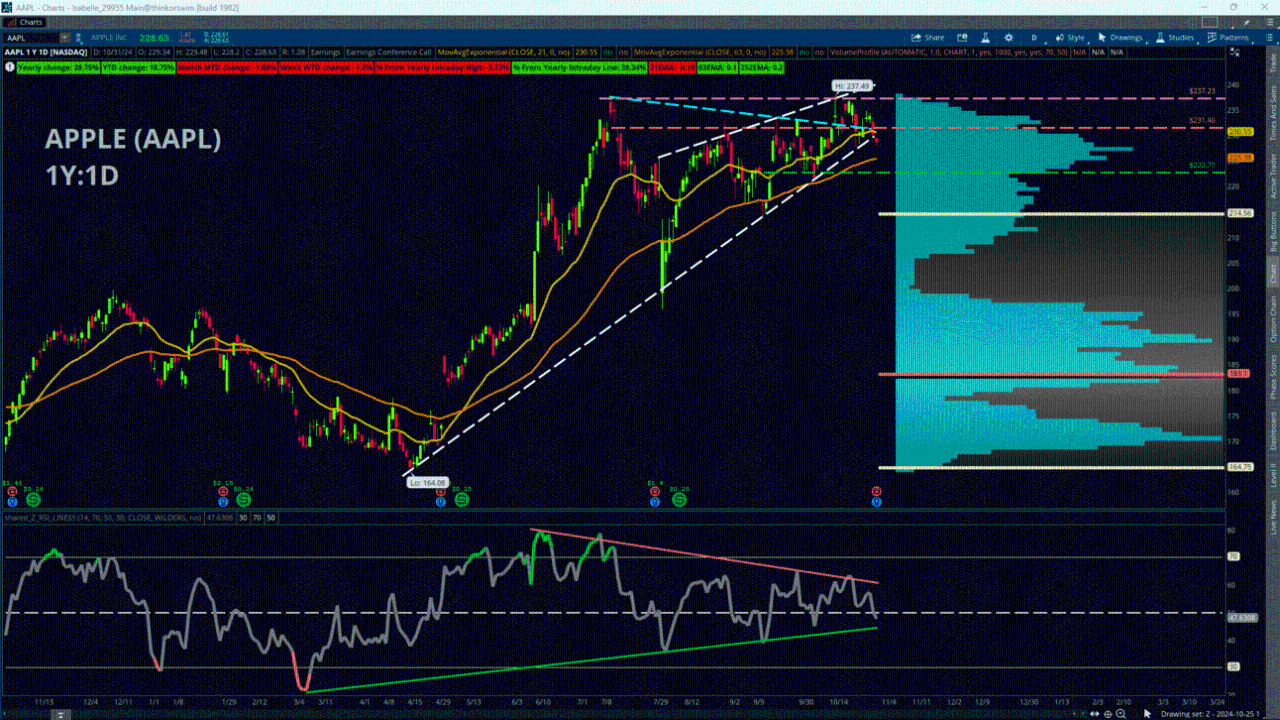

Apple enjoyed a strong rally that began with the 52-week lows of 164.08 on Apr. 22, and shares are up about +40% from that point as of yesterday’s close. By one measure, price broke above a downward trendline beginning with the July highs, yet was unable to make a meaningful push above that same level near 237. The move dissipated yesterday, with price sinking back below the trendline, and below a repeated ceiling of resistance around 231. If price continues to the downside, watch for a longer-term trendline starting with the 52-week lows to hold, and then look toward the 63-day Exponential Moving Average around 225 for further support. To the upside, the old double-top highs near 237 are the clear mark to beat.

Amazon’s chart showed much more of a sideways drift than Apple in recent months, compressing into a symmetrical triangular shape after the steep rally off the Aug. 5 lows moderated. However, bulls saw a breakout yesterday; price surged above the upper boundary of the triangular shape (a trendline beginning with the 52-week highs of 201.20 from Jul. 8 and connecting to the subsequent highs from late September).

The caveat is that price stopped short near those same late September highs near 195 – which also happens to be roughly the site of the yearly Linear Regression Line another source of potential resistance. This is a key price point for bulls to overcome, and the next potential hurdle is the highs near 201. To the downside, look near 190. This has been a frequent stopping point for price during the past year, and also lines up closely with the now-broken downward trendline off the highs, so this could be a likely candidate for support.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.