Markets Fracturing, But Not Breaking Yet

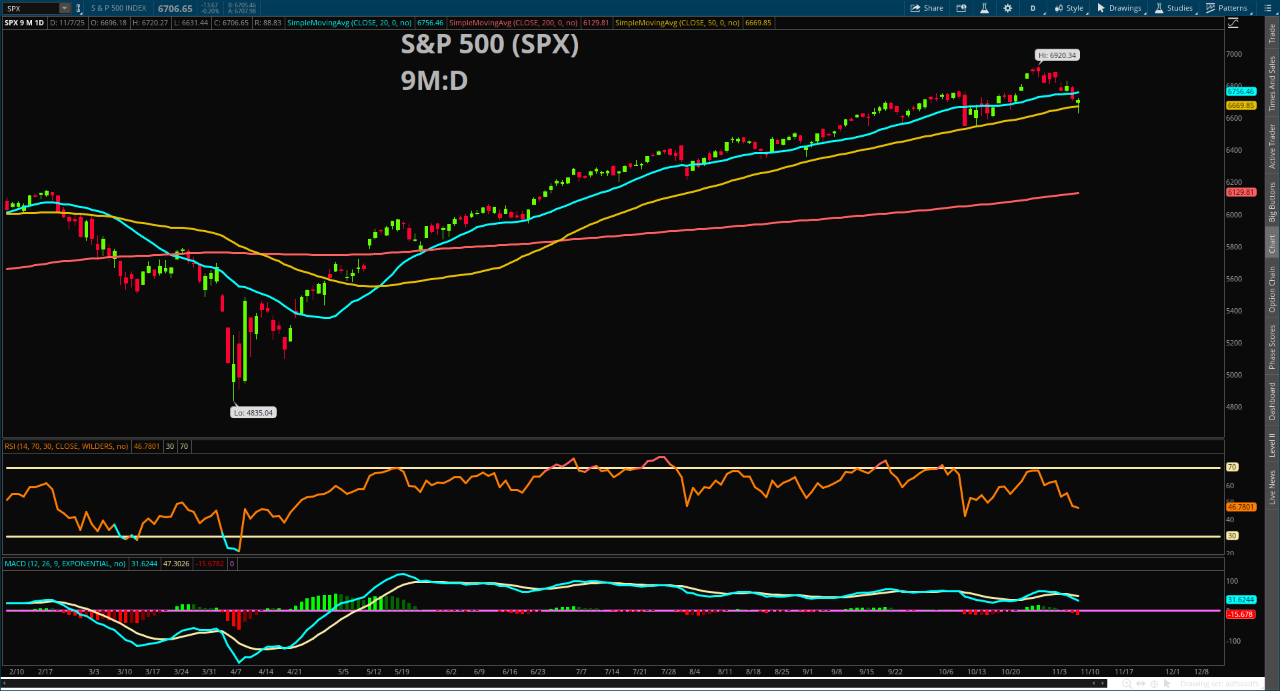

Last week, the market experienced a rare pullback in this bull cycle, with both the S&P 500 and Nasdaq-100 declining more than 2%. Both indexes closed below their 20-day simple moving averages (SMA) for the week. Volume was notable, as the technology and communication sectors, which together make up more than 45% of the S&P 500, saw aggressive selling following earnings announcements and renewed concerns about “lofty” valuations in A.I. related stocks. But is this more than just a simple pullback?

Although the drawdown feels aggressive, the S&P 500 is still making higher highs and higher lows from a technical standpoint. Yes, the 20-day SMA has been broken—but we’ve seen that happen before during this bull run since the April lows. In fact, the S&P 500 has tested and closed below the 20-day SMA more than eight times since the April 23rd breakout, only to rebound and make new all-time highs. So, is it an important indicator? Yes, but like any technical measure, it’s not the holy grail.

The index is now testing the 50-day simple moving average, marking its first major test of this level since May 1st. By “major test,” I’m referring to a cross below the moving average on an intraday basis—often referred to as a violation of the moving average. The coming sessions will show how the market responds. Even if we see a “dead cat bounce,” many technicians this weekend will be closely watching that level.

The MACD (Moving Average Convergence Divergence) has entered a “first signal” bearish formation, with the 12-day exponential moving average crossing below the 26-day exponential moving average, a near-term bearish signal suggesting momentum has shifted from bullish to bearish. However, the MACD remains above the zero line, meaning the “second signal” confirming a full bearish turn has not yet occurred.

With that in mind, the market is still making higher highs and higher lows. Until the S&P 500 breaks below—and stays below—6,550 for several sessions, the broader trend remains bullish. That said, the concentration in mega-cap stocks that has fueled the index’s gains in recent months has now become a headwind. With Nvidia’s (NVDA) earnings approaching on November 19th, the best outcome for traders may be a healthy rotation out of overextended tech names and into the more undervalued, overlooked sectors—a rotation that may already be underway, as seven sectors still managed to end the week in the green despite the overall market decline.

Regardless of your thoughts on valuations—and trust me, some of the concerns are valid, as history suggests—the technical nature of this bull run has been the guiding light that hasn’t dimmed yet. One day it may, but until then, the technical trend is still higher.

Featured Clips