Market Minute: The Logic for Powell Points to 50

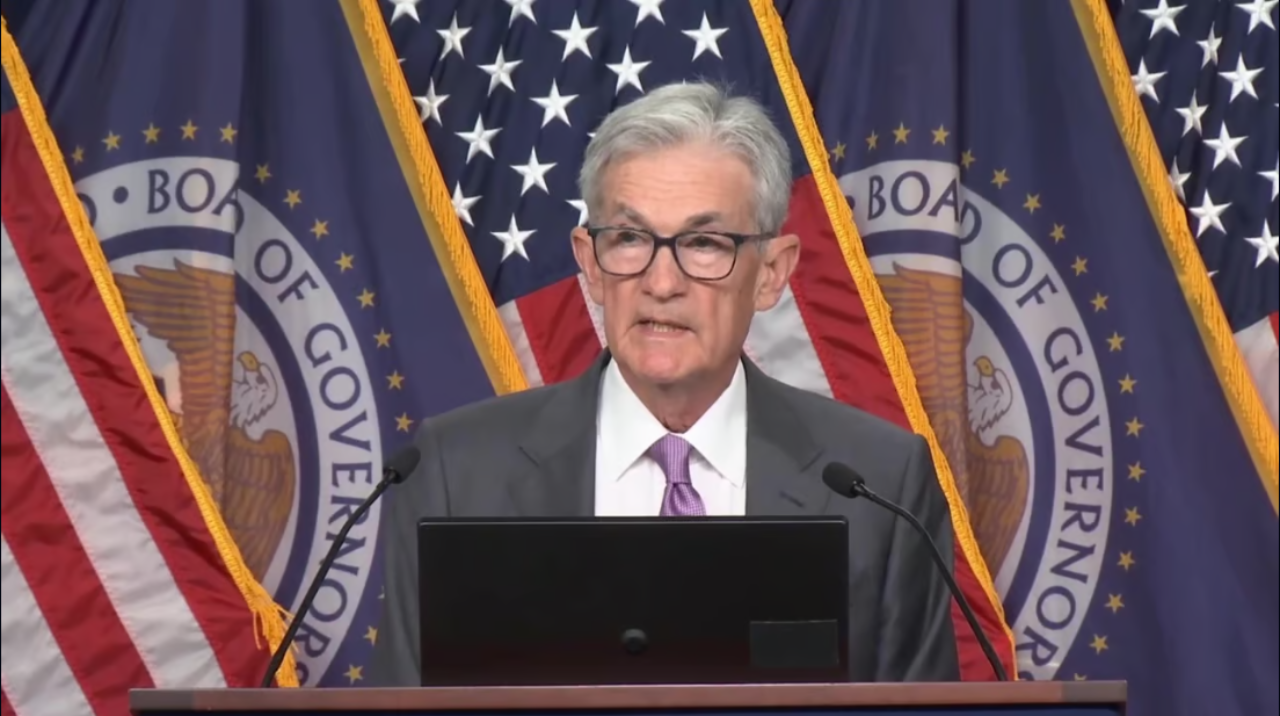

Jerome Powell and the Federal Reserve should probably cut 50 basis points today. There's sound economic reasoning, and there is even more compelling game logic from the perspective of the decision-makers.

First, the economic justification. Inflation is indeed not yet at the Fed's target but it's way down from its peak of near 10% and the risk that it suddenly accelerates looks the lowest it's been in years. The bond math is pretty incontrovertible: interest rates at this level are restraining the economy probably far more than is required to continue pressuring inflation.

Unemployment is rising at a pace that historically leads to recession. Long bonds have un-inverted in a fashion that normally precedes recession. Nominal levels of employment and activity may not be alarming, but the deterioration of the labor market is real. If Powell & Co believe rates have a real impact on economy, and the neutral rate is substantially lower, it behooves the Fed to make a bigger move early so to have the greatest chance of reversing negative employment trends.

That's the economic case. Then there's the calendar, and the reality of the year 2024. This is the last FOMC decision before the election, and one Presidential candidate's team is saying they'll replace you as soon as possible (see my Market Overtime interview with senior Trump adviser Stephen Moore). Technically, Powell has a term to serve into the next administration, but do you want to count on that?

If Powell believes 1) a resurgence in inflation is a significantly lower risk than deterioration in employment, 2) interest rates are an effective tool and the bigger you go the bigger the impact, and 3) there's a non-zero chance it may be your last opportunity to say you did everything you could to pull the lever to land the plan softly, you go for 50.

Nick Timiraos of the WSJ – the Fed whisperer, some say – wrote in a tweet thread this week that the case for 50 was about "regret minimization." The concept of regret minimization is the cornerstone of machine learning and Game Theory optimal poker play. In this case the game theory logic, in multiple ways, points to 50 is the best way to minimize Powell's potential regret.

As far as the reaction, even though the market is now technically expecting 50, there's probably still some juice to be squeezed from the macro trade of lower yields and dollar. For stocks, small-caps and rate sensitive value/low-quality names should outperform. As long as the rotation doesn't come at the cost of the Mag 7, the SPX rally should be able to finally extend past the range and through to a new high. If the Fed goes 25, look for a short-term reversal higher in yields and the dollar. A softer-touch Fed isn't a bear case on its own, but stocks at this point might throw a small fit temporarily.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.